This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Group Profile & Structure

1855

ESTABLISHED

1871

BRITANNIA P&I FORMED

2018

BRITANNIA EU

2024

3549 SHIPS ENTERED

PROTECTION & INDEMNITY

We provide shipowners and charterers (called Members) with Protection and Indemnity insurance (P&I) as well as Freight, Demurrage and Defence insurance (FD&D).

Trusted by our Members since 1855, the Britannia Group (or Britannia P&I) is the oldest P&I Club in the world. We have built a reputation for financial soundness and providing an exceptional standard of service for our Members worldwide.

CORE VALUES

The Britannia Group’s core values are Mutuality, Trust, Integrity, Expertise and Excellence. Our priority is our Members and our track record of financial strength together with a premium service, have established Britannia P&I as one of the market leaders in the International Group of P&I Clubs.

MUTUALITY

We are committed to mutuality. As a mutual insurer we do not have to answer to shareholders, only to our Members, most of whom have been with us for many years. When considering new Members, we look to ensure that they mirror our values.

Our mutuality allows us to write each Member’s premium based on their individual risk and claims record over a ten-year period. Underpinning this, our experienced team supports all of our Members by providing professional and proactive advice on loss prevention and claims management. Understanding our Members enables us to adapt our services to meet their needs.

CORPORATE STRUCTURE

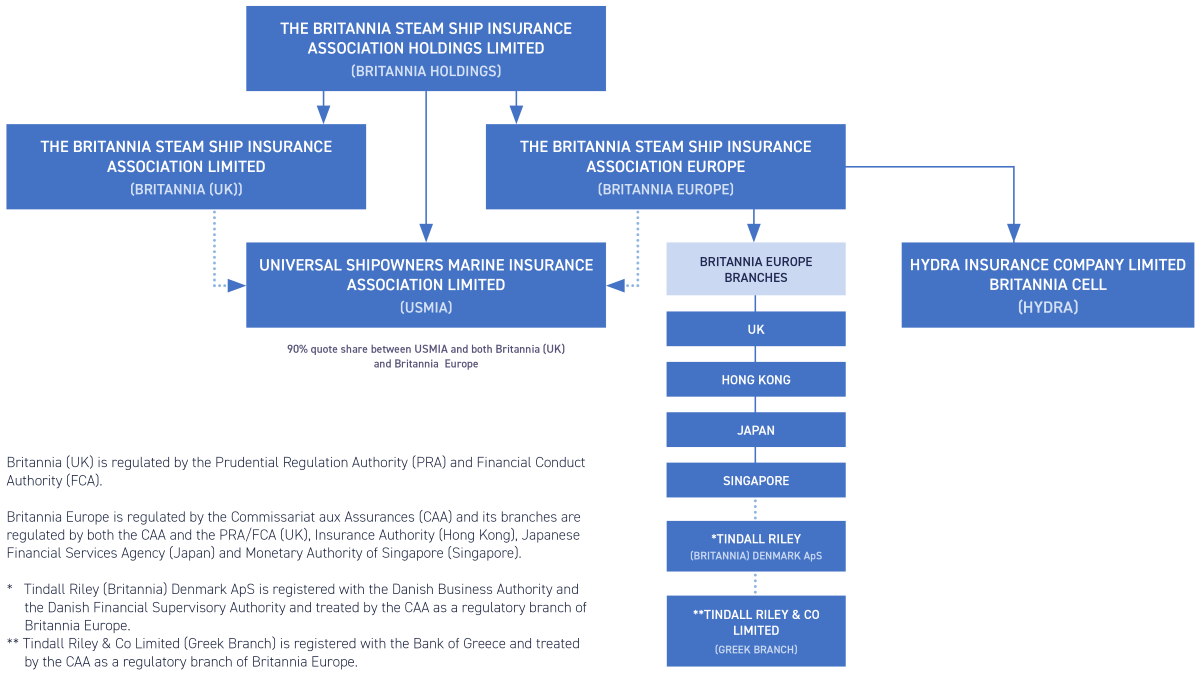

The Britannia Group consists of:

- The Britannia Steam Ship Insurance Association Holdings Limited (Britannia Holdings), which has the controlling interest in its providers:

- The Britannia Steam Ship Insurance Association Europe (Britannia Europe) and

- The Britannia Steam Ship Insurance Association Limited (Britannia (UK)) and

- Two Bermudian based reinsurers:

- Universal Shipowners Marine Insurance Association Limited (USMIA) and

- Hydra Insurance Company Limited – Britannia Cell.

Whether you are insured by Britannia Europe or Britannia (UK), every Member is part of and benefits from the strength of the Britannia Group.

The following chart shows our corporate structure in more detail.

PRUDENCE & INVESTMENT

Our prudent approach, focusing only on our core business with no other distractions or risks, enables us to manage Britannia P&I solely for the benefit of our Members. That prudency means we have had no unbudgeted calls for over 50 years.

Our financial reserves remain amongst the strongest in the market, materially in excess of Solvency II minimum requirements. Nevertheless, we recognise the need, as with the entire P&I industry, to increase rates to breakeven while using our financial strength to manage that process. In the meantime, Standard & Poor’s rate us as ‘A’, with AAA capital and Exceptional Liquidity. However, to reflect current underwriting deficits in the P&I market our outlook was revised to negative from stable.

INVESTMENT STRATEGY

We employ a cautious investment strategy. Our aim is always to preserve capital yet, at the same time, achieve a respectable rate of return, to support our underwriting activity. Therefore, we invest in a diverse range of assets, while recognising our commitment to sustainability. Those assets include cash, to maintain liquidity, and five types of bond: government, conventional, index-linked, corporate and absolute return. In addition, we invest in diversified growth funds and equities.

English

English